MAX Intelligence: Panama Canal Disruptions

- MAX Security

Table of Contents

Panama Canal to be operational at full-capacity by 2025 but likely to face recurring disruptions in coming years

Executive Summary

-

The Panama Canal has been recording operational hinderances amid extended drought conditions in 2023 resulting in global shipping disruptions, which have been improving since March due to swift water management measures and have been able to somewhat contain the disruptions by June.

-

Vessels, primarily LNG and bulk carriers without reserved slots to pass through the canal, were most impacted by disruptions, while containerized cargo vessels continued to operate at profit margins after being able to reserve slots, albeit at increased costs.

-

Efforts are already being employed to minimize global shipping disruptions amid the high potential for the recurrence of severe drought conditions, but these are unlikely to manifest in the coming years. This warrants the need for alternative routes, intermodal transportation, and regionalized supply chains.

-

Businesses and consumers worldwide should allot for disruptions for operations along the Panama Canal due to ad-hoc capacity and daily transit restrictions amid recurring and extended drought periods.

Overview & Outlook

Disruptions caused to global shipping in light of climate risks posed to Panama Canal

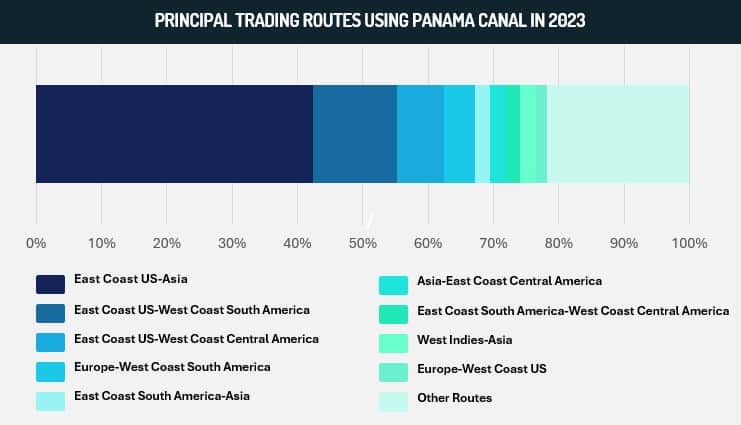

The Panama Canal, an 82 km interoceanic corridor connecting the Pacific and Atlantic Oceans through Panama, is a highly strategic global maritime trade route. It is understood to cut down the shipping time for moving goods from Asia to the US East Coast to 35 days from the 41 days for ships using the Suez Canal. Trade between Asia and the US East Coast accounts for 42 percent of the Panama Canal’s total traffic in 2023 with the canal together supporting approximately six percent of the world’s maritime commerce. The USA dominates canal usage, with over 71 percent of traffic originating there or destined for its markets, followed by China with 22.7 percent. Additionally, several Latin American countries including Guatemala, Chile, Ecuador, and Panama depend heavily on the canal.

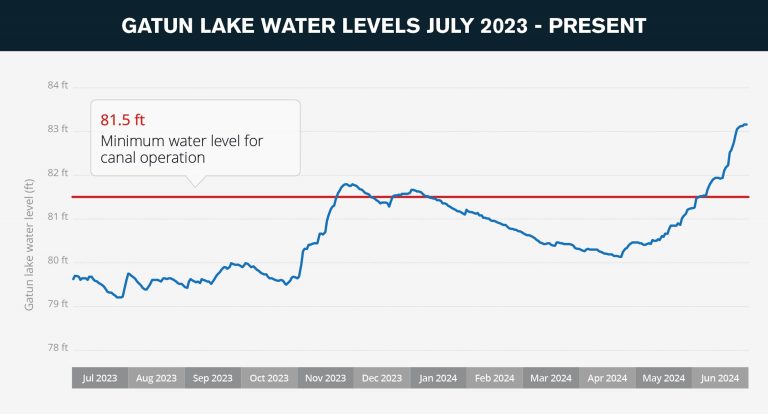

The canal is sustained by two artificial freshwater lakes, Gatun and Alajuela, which are replenished by rainwater during the rainy season from May to November. Due to the elevation difference between the sea level and the lakes, the canal utilizes lock systems that raise and lower vessels through gravitational water flow to facilitate the movement of ships across the canal. Given this dependence on the rainy seasons, the Panama Canal is threatened by drought conditions. While the country has recorded drought seasons a couple of times in the past, extended drought conditions caused by an El Nino-Southern Oscillation (ENSO) in 2023 significantly affected operations across the Panama Canal. The ENSO weather phenomenon decreased precipitation and delayed the rainy season, with higher temperatures for an extended period amplifying evaporation rates and reducing the water levels of the artificial freshwater lakes. This resulted in the Panama Canal recording the historically second driest year in 2023 since 1950, which manifested in operational constraints impacting the efficiency of the canal.

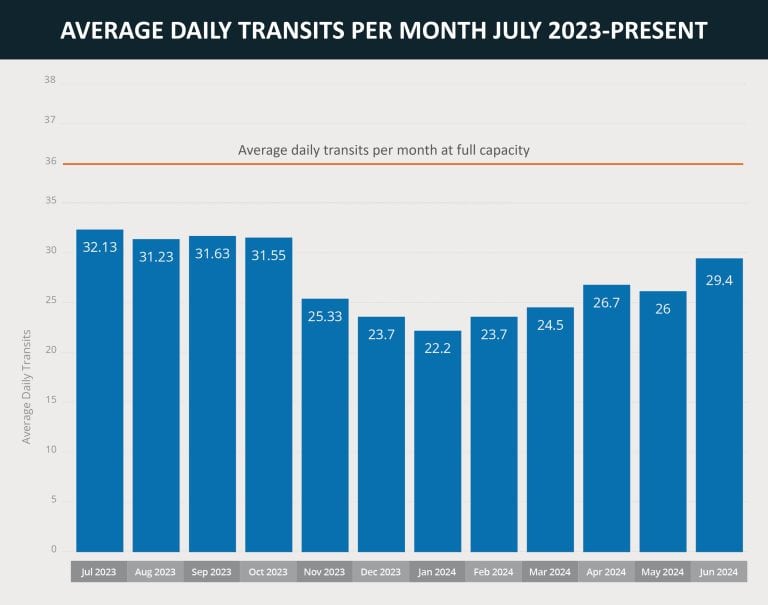

While at 36 vessels transit the Panama Canal in an average month, due to operational constraints as the Gatun Lake reached unprecedented low water levels there were restrictions placed on daily transits capping at 22 vessels throughout late 2023. This came as the Panama Canal authorities implemented strict water-saving measures since late July 2023 to offset the impact of the extended drought conditions by saving rainwater to allow continued operations through the January to April dry season of 2024. Some of these measures were unprecedented and raised concerns regarding the implications of climate change on the sustainability of the Panama Canal operations.

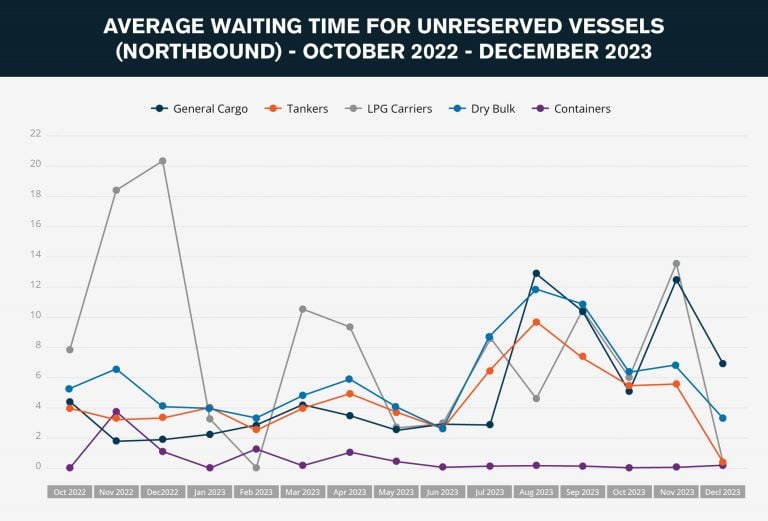

Usually, the canal authorities have a system allowing ships to book slots to pass through the canal, which is very expensive but allows vessels to pass with only two days of waiting period and significantly reduces the overall shipping time. Available slots are auctioned off at exceptionally high prices, reaching one to two million USD in addition to the transit fee. Nearly three-quarters of vessels make reservations and typically arrive one or two days before their scheduled transit, keeping the average number of vessels awaiting transit in line with expectations, even with the restrictions. For booked ships, this waiting period remained unchanged despite the restrictions, however, vessels looking to pass the canal without the bookings recorded waiting periods between nine to 20 days, thus causing significant shipping delays and increased expenses.

This was specifically evidenced by the impact of the Panama Canal restrictions on the transport of energy products and grains from the US to Asian countries including India, Japan, Korea, and China. The number of LNG carriers transiting the Panama Canal fell six percent in 2023 compared to 2022 with several of these carriers opting to use the Suez Canal or the Cape of Good Hope in South Africa. Additionally, LNG carriers expect a two to three-day wait when using the Panama Canal, but the waiting period increased significantly, averaging about 15 days by mid-December 2023 for unreserved slots. Furthermore, the LNG carriers that transited the canal were forced to decrease their payload, resulting in a 15-20 percent capacity reduction per trip.

Similarly, bulk carriers moving crops from the US Gulf Coast to Asia also preferred the longer routes and paid higher freight prices to avoid congestion at the Panama Canal, where the increased slot prices also made it unsustainable for the traditionally low-margin grain trading business. Bulk carriers chose to move around South America or Africa, or transit via the Suez Canal, adding two weeks to shipping times, and raising inventory holding costs, including costs for fuel, crew, and cargo leasing. Moreover, while some US exporters also sought to divert crop shipments from the Pacific Northwest Ports to Asia, such diversions also incurred additional costs due to the land movement of agricultural goods by rail to the Northwest Ports. Such increased shipping costs consequently resulted in increased consumer costs, thus adding to the already high prices and inflation.

The restrictions imposed by the Panama Canal authorities appeared to have presented the most challenges for vessels that do not have fixed schedules and rather depend on when they are loaded, which makes it difficult for such vessels to book slots. This includes oil tankers, LNG carriers, and bulk carriers. On the other hand, container ships, passenger ships, refrigerated cargo ships, and automobile carriers were the least affected. The decreasing competition from other types of vessels also makes it easier for containers to reserve slots. These factors, coupled with containerized cargo’s typically low inventory holding costs, enable containerized cargo to absorb the excess costs.

Periods of prolonged drought have previously impacted the Panama Canal, prompting the canal authorities to undertake preemptive measures to mitigate the impact but the supply chain disruptions caused in 2023 were more pronounced largely because they converged with multiple other geopolitical escalations impacting maritime chokepoints. This includes mainly the Yemeni Houthi attacks targeting ships transferring the Red Sea, off the coast of Yemen, and causing several shipping companies to use alternative routes around the African continent rather than using the Suez Canal through the Red Sea. Thus, the overall compounded pressure in 2023, bolstered the impact of Panama Canal restrictions employed to manage drought conditions on the global shipping industry. That said, the canal operations are recovering gradually amid the onset of the rainy season of 2024 with the authorities easing canal restrictions and the consequent impact on global shipping. However, the situation has encouraged the Panama Canal authorities to implement measures to expand the operational capacity of the canal to limit the disruptive impact on global shipping in the future.

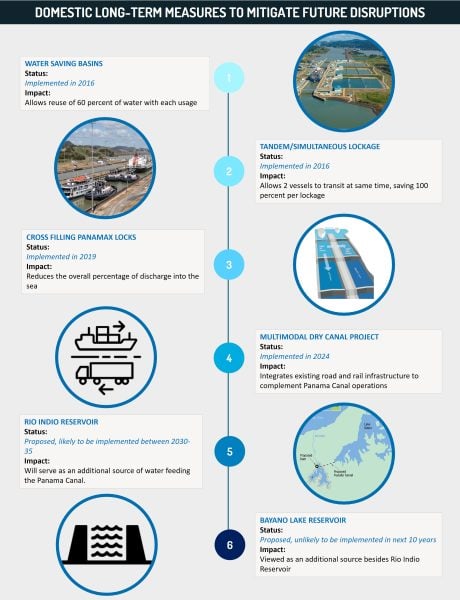

Water management strategies, improved weather conditions to alleviate operational strain in coming months, unlikely to lead to long-term sustainable solution

The restrictions on daily transits were expected to continue through the early months of 2024 but heavy rainfall in November and December 2023 offset some of the operational concerns and allowed the canal authorities to increase January’s daily transits. Since then, the daily transit slots have grown incrementally to 32 in June 2024 to almost be at par with normal operations of daily transits of 36 vessels in a month. FORECAST: As water levels increase and transit slot restrictions ease, transit fees can be expected to be reduced in two to three months. Moreover, authorities are poised to accelerate water management strategies, leveraging anticipated increased rainfall and water availability in the Panama Canal watershed, the legally approved land around the canal allowed to be used for the benefit of the canal. This is aided by the projected onset of La Nina, the ENSO’s cool phase between July and September. Given these strategies including optimizing the use of water-saving basins, cross-filling the Panamax locks, and simultaneous lockage, the authorities are expected to enable operations at full capacity in the coming months as well as prepare for the dry months of 2025.

Nonetheless, some of these measures such as draft restrictions and daily transit slots, while announced at least a month in advance, are ad-hoc in nature and react to the drought conditions when they occur, providing only short-term relief. The long-term sustainability of the operations across the Panama Canal is contingent on additional water management projects. To that end, the authorities submitted a proposal in September 2023 to build a new reservoir across Rio Indio. This proposed reservoir is beyond the legal watershed limits of the canal and thus was prohibited by a law from 2006. However, the Supreme Court on July 2 declared this law “unconstitutional”, thereby legally allowing the authorities to build the new reservoir in the Rio Indio River and generally extend the canal’s watershed for water management projects in the future. FORECAST: Thus, this ruling increases the likelihood of the project of the new reservoir being realized, particularly in a pro-business environment where the newly elected President Jose Mulino widely campaigned on supporting legislation that would alleviate the Panama Canal disruptions.

FORECAST: That said, Mulino may hesitate to expedite approvals for resource-intensive infrastructure projects beyond the older limits of the Panama Canal watershed in the coming months. This caution stems from heightened environmental activism given that the local communities fear that constructing a new reservoir for the Panama Canal could flood their farms and homes, requiring resettlement. Local concerns against a new reservoir are also fueled by the probability of water management measures jeopardizing a stable supply of drinking water for the local communities. Furthermore, such water management projects will likely be leased to foreign firms, which will stoke public sentiment since it may result in the establishment of a specialized jurisdiction akin to the former US-controlled “Panama Canal Zone enclave” until 1999. This concern is compounded by the potential for specialized jurisdiction projects to be viewed as compromising Panama’s sovereignty. Thus, extensive dialogue with the local communities is expected before any potential project approvals. This may result in the government approval for the construction of a new reservoir being delayed for at least a year.

FORECAST: Once the government permits the construction of the new reservoir the Rio Indio River, the construction is likely to take four to six years. The construction period will also include an additional 18-24 months of consultations with the local community directly impacted by the reservoir, consisting of around 12,000 residents, disagreements citing environmental or displacement concerns, could potentially delay the project’s actual construction. Further delays can be expected due to environmental surveys and other permissions. Finally, unforeseen technical or logistical issues during the construction phase or inclement climatic conditions such as another drought period or severe hurricanes could also push the completion beyond the six-year target.

FORECAST: Given these circumstances, the proposed new reservoir is unlikely to improve operational capacity of the Panama Canal by the next ENSO cycle, which occurs irregularly every two to seven years. In the best-case scenario, the project would be ready only by 2030, possibly after at least one additional ENSO cycle, which will likely once again severely impact operations at the canal. Such a scenario would coerce vessels without fixed schedules, especially oil tankers, LNG carriers, and bulk carriers, to opt for alternative maritime routes traversing around the Cape of Good Hope, through the Strait of Magellan around South America, or the Suez Canal, all resulting in a significant increase in operational costs and shipping delays. The higher shipping costs will be passed on to the importers and consumers.

Given this situation, the Panamanian government launched in April the Multimodal Dry Canal Project, aimed at mitigating the impact of future canal restrictions by providing a land-based alternative for transporting goods. The project integrates existing roads, railways, ports, airports, logistics warehouses, and Special Economic Zones (SEZs) into a new special customs jurisdiction spread across the provinces of Colon, Panama, and West Panama. The government has also established new procedures to reduce the paperwork required for the land movement of the cargo, potentially increasing the speed of clearance and reducing the cost of movement. The new regulatory framework will streamline the digitalization of customs processes. FORECAST: Given that this alternative does not require new infrastructural investments, the project is unlikely to be capital-intensive. Nonetheless, streamlining the customs procedures across this special jurisdiction and ensuring traceability of the cargo along the land route will require additional human and technological capital, in turn requiring increased coordination between Logistics and Customs authorities. Although authorities claim that the project was already implemented in April, the overall integration of newer routes and transport terminals to the special customs jurisdiction, coupled with training and recruitment, is projected to take over at least a year, thereby enabling the project to reach its full capacity only by 2026.

FORECAST: In this context, the land route is likely to be operational by the next ENSO cycle with the diversifying transportation strategies reducing dependence on the Panama Canal route. This will likely alleviate cargo congestion, ensuring Panama’s resilience in maintaining critical trade operations even during unfavorable environmental conditions affecting canal transit. The land route will help restructure global supply chains and reduce the pressure on the Panama Canal as well as the global shipping industry considering unforeseen disruptions to the canal operations. That said, the land route compromising of roads, railways, ports, airports, and logistics warehouses can be expected to significantly increase the time required for the transportation of goods across Panama. Additionally, this will also entail increased costs and paperwork for transport businesses given the involvement of different transportation hubs along the route. Thus, while the land route will help alleviate disruptions to shipping during drought conditions affecting the Panama Canal operations, it will not replace the canal.

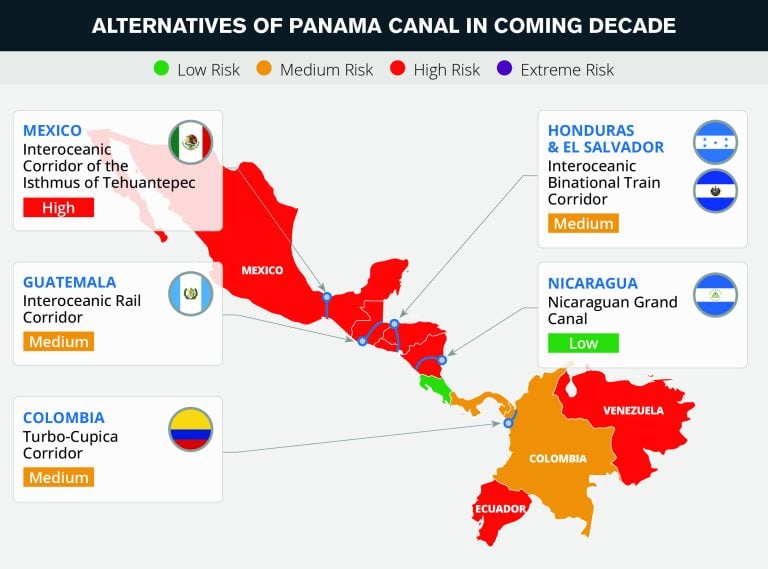

Meanwhile, there have also been proposals for feasible regional alternatives to the Panama Canal. Various substitutes for the Panama Canal have been proposed since the early 2000s, such as Colombia’s Pacific Rail Corridor, Mexico’s Interoceanic Corridor of the Isthmus of Tehuantepec (CIIT), the Bi-oceanic corridor between Brazil and Chile, and the suspended Nicaraguan Canal project. However, none of these projects are anticipated to be completed or viable within the next decade, besides Mexico’s CIIT, which has been developing since 2019. In addition to serving as a route for the transfer of goods, the CIIT seeks to become an industrial belt that receives raw materials at one point and as it passes through the Isthmus of Tehuantepec, is transformed into finished products. The CIIT includes a 1,096 km railway divided across three railroads, of which only one is fully operational as of July with the other two railroads projected to be completed by 2025.

FORECAST: Furthermore, the inaugurating dry bulk train along the operational railroad moved at a very slow speed, raising concerns that even once the project is finished, the movement of heavy cargo is likely to be slow-paced in the first few years with the cargo capacity likely to be limited. The CIIT also includes the establishment of 15 industrial zones and four ports requiring expansion to accommodate post-Panamax ships and additional container terminals. Although authorities have estimated a five-year timeline for the completion of all CIIT-related infrastructure projects, given the precedent of the time taken to construct the existing operational parts of the CIIT, the pending projects would likely take eight to 10 years to complete.

FORECAST: Thus, this alternative is expected to reach full operational capacity only by 2033. While a further delay to the establishment of industrial zones can be expected beyond 2033, the rail and road infrastructure are expected to be fully operational in the next 10 years at best. Notwithstanding, once operational, the route will be increasingly susceptible to cargo thefts, a trend often recorded in central and northern Mexico around distribution centers, with the current security apparatus ineffective in abating this rising risk. The route also passes through high-risk states with heightened levels of cartel violence, with the CIIT expected to become a lucrative target for organized criminal groups. Given these conditions, even when the CIIT becomes operational by at least 2033 unless the Mexican authorities implement security measures to specifically address the security threat posed to the transiting cargo from criminals and cartels, businesses are likely to face significantly increased costs related to ensuring safety of their cargo while transiting through this route. The security risk may also discourage some businesses from even opting for this route, particularly if the disruptions associated with the Panama Canal have been alleviated in the future.

Overall, operations at the Panama Canal are expected to improve in the coming months with the onset of the rainy season and increased precipitation anticipated with ENSO conditions transitioning to the La Nina phase between July and September. Given this, draft restrictions are expected to ease, with operations expected to be at full capacity by 2025. Nonetheless, measures such as water management projects and ongoing construction for the alternative Panama land route are unlikely to be completed by the next ENSO cycle slated to occur in the next two to seven years. This will likely result in the recurrence of global shipping disruptions as the authorities can be expected to implement

Recommendations

-

Despite drought related operational restrictions easing as compared to 2023, businesses and consumers worldwide should remain cognizant of updates by Panama Canal authorities on routine ad-hoc water-saving restrictions on daily transits and draft capacity.

-

Reassess the operating costs of traveling via the canal amid peak drought conditions and if needed, opt for alternative routes via the Cape of Good Hope or the Magellan Strait, especially for LNG carriers and dry bulk cargo.

-

It is advised to have business continuity plans ready in light of the possibility of recurrence of restrictions on daily transits and capacity by the Panama Canal authorities.

-

For any questions and risk assessments, please contact intel@max-security.com.

SCOUT

INTEL AI BY MAX SECURITY

Fill in your details to schedule a demo with our team.